#799 - Rejeição 799: Valor total do ICMS Interestadual da UF de destino difere do somatório dos itens

Causa

Quando for emitida uma NF-e e nos Totais do documento o Valor do ICMS Interestadual para a UF de Destino (ICMSTot / vICMSUFDest) FOR apresentado valor que difere somatório do Valor do ICMS Interestadual para a UF de Destino (ICMSUFDest / vICMSUFDest) de cada item, será retornado a rejeição "799 - Valor total do ICMS Interestadual da UF de destino difere do somatório dos itens".

O cálculo do Total do Valor do ICMS Interestadual para a UF de Destino (ICMSTot / vICMSUFDest) é feito a partir do somatório dos campos abaixo:

vICMSUFDest (Item 1)

vICMSUFDest (Item 1)

vICMSUFDest (Item 2)

vICMSUFDest (Item 2)

vICMSUFDest (Item n)

vICMSUFDest (Item n)

vICMSUFDest (Total)

vICMSUFDest (Total)

O vICMSUFDest permite um arredondamento de no máximo R$ 0,01

Exemplo hipotético:

Foi emitida uma NF-e com dois itens informados, cada um com o valor do ICMSUFDest de R$ 39,99. O sistema ERP ao realizar a soma do valor do vICMSUFDest de cada item para preencher o Total realizou arredondamento do valor para R$ 40,00 em casa item, totalizando R$ 80,00. Nessa situação a NF-e será rejeitada pelo motivo 799.

- No XML:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 |

|

- No TXT-SP:

H|1||

I|49755855||NF-E EMITIDA EM AMBIENTE DE HOMOLOGACAO - SEM VALOR FISCAL|27101932|||6102|UN|1|999.99|999.99||UN|1|999.99|||||1||||

M|

N|

N02|4|00|3|999.99|7.00|70.00|

NA|999.99|2.00|17.00|7.00|40.00|20.00|39.99|60.00|

Q|

Q02|01|999.99|1.65|16.50|

S|

S02|01|999.99|7.60|76.00|

H|2||

I|49755855||NF-E EMITIDA EM AMBIENTE DE HOMOLOGACAO - SEM VALOR FISCAL|27101932|||6102|UN|1|999.99|999.99||UN|1|999.99|||||1||||

M|

N|

N02|4|00|3|999.99|7.00|70.00|

NA|999.99|2.00|17.00|7.00|40.00|20.00|39.99|60.00|

Q|

Q02|01|999.99|1.65|16.50|

S|

S02|01|999.99|7.60|76.00|

W|

W02|1999.98|140.00|0.00|40.00|80.00|120.00|0.00|0.00|1999.98|0.00|0.00|0.00|0.00|0.00|33.00|152.00|0.00|1999.98||

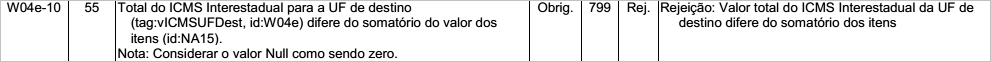

Veja regra de validação da Sefaz:

Como Resolver

Deve-se realizar a soma do vICMSUFDest de cada item, e informar resultado dessa soma nos Totais da NF-e que tenha o valor igual ou com diferença máxima de R$ 0,01 (um centavo).

Realizando o cálculo:

vICMSUFDest = 39.99 (item 1)

vICMSUFDest = 39.99 (item 1)

vICMSUFDest = 39.99 (item 2)

vICMSUFDest = 39.99 (item 2)

vICMSUFDest = 79.98 (total)

vICMSUFDest = 79.98 (total)

- No XML:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 |

|

- No TXT-SP:

W|

W02|1999.98|140.00|0.00|40.00|79.98|120.00|0.00|0.00|1999.98|0.00|0.00|0.00|0.00|0.00|33.00|152.00|0.00|1999.98||

Feita a correção dos Totais vICMSUFDest, basta reenviar a NF-e para processamento.